You, the Hero—Facing Unseen Risks

Picture this: you’re driving home from the office on I-285 during a sudden June downpour. A momentary skid, and you collide with several vehicles. Five people are injured—two require emergency surgery, one sustains a traumatic brain injury—and total medical and repair costs top $1.2 million. Yet Georgia’s minimum auto liability limits are just $25,000 per person and $50,000 per accident. Without extra protection, you’d be responsible for the $1.15 million shortfall—jeopardizing your home equity, retirement nest egg, and future earnings.

Standard auto and homeowners policies shield only up to their capped limits. Once those are exhausted, every asset you’ve built becomes fair game for claimants and their attorneys.

We Understand Your World—and the Stakes

At Concierge Insurance Group, we specialize in private client services tailored for extraordinary lifestyles. Our team of exclusive underwriters and risk advisors has guided dozens of North-Atlanta families through Georgia’s evolving legal landscape, ensuring peace of mind no matter where life takes them.

The Plan: Three Steps to Total Protection

- Assess Your Asset Footprint

- Inventory home equity, vehicles, investments, and potential future earnings.

- Identify exposures from teenage drivers, vacation homes, boats, or rental properties.

- Layer in Broad “Anywhere” Coverage

- Secure an umbrella policy that sits atop your auto, home, and watercraft insurance.

- Confirm defense costs are in addition to—not within—your coverage limit.

- Partner with a Georgia Private Client Specialist

- Leverage local expertise on tort reforms, social host liability, and weather-related risks.

- Schedule an in-home risk audit and annual policy review after any major life change.

Why Umbrella Liability Is Essential in Georgia

- Low State Minimums

- Georgia’s $25/50/25 auto limits haven’t kept pace with rising medical and repair costs (Source 1).

- Modified Comparative Negligence

- Even a partially at-fault judgment can leave you paying your share of a multimillion-dollar verdict.

- Social Host Exposure

- Serve a guest at your home event? Georgia law can hold you liable for harms they cause afterward (Source 2).

- Global Incidents

- From slip-and-falls at a Caribbean resort to defamation claims on social media, umbrella coverage travels with you.

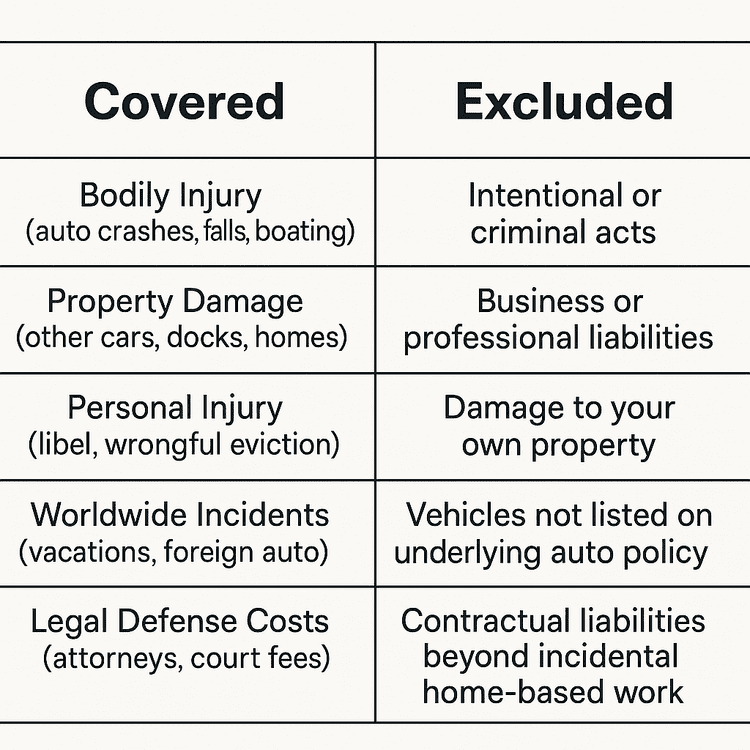

What’s Covered—and What Isn’t

Real-World Success Stories

- Chain-Reaction Crash, Atlanta

- $1.2 million judgment; auto limits paid $75 K → umbrella covered $1.125 M.

- Savannah Holiday Party

- $2.5 million social host suit; homeowners paid $300 K → umbrella covered $2.2 M.

- Lake Lanier Boating Collision

- $1.15 million in claims; boat policy paid $300 K → umbrella covered $850 K.

- Augusta Dog-Bite Incident

- $750 K in medical claims; homeowners disputed $100 K → umbrella paid $550 K.

- Small-Town Defamation

- $500 K reputational suit; personal policy unclear → umbrella covered $575 K.

All premiums for these Georgians ranged from $300–$400/year—less than a daily latte but protecting far more.

Choosing Your Coverage Level

- $1 Million Starter: Ideal for estates up to $600 K in home equity.

- $2–3 Million Tier: Fits families with higher-value homes, teen drivers, or secondary properties.

- $5 Million+ Ultra-High Net Worth: For multiple residences, businesses, and significant future-earnings exposure.

Adjust tiers to reflect Georgia’s litigious environment, medical inflation, and recreational exposures.

Your Next Steps—Secure Peace of Mind Today

- Review Underlying Limits

- Ensure at least $250 K/person and $500 K/accident BI, plus $100 K PD on auto; $300 K liability on home.

- Inventory Special Assets

- List boats, RVs, rental homes—confirm they’re included on your base policies.

- Request Multiple Private Client Quotes

- Compare captives and independents for best terms, service, and discounts.

- Coordinate Effective Dates

- Align umbrella start date immediately after your underlying policies bind.

- Implement Risk Mitigation

- Invest in home safety upgrades, driver training, and cyber-security to earn rate credits.

- Schedule Annual In-Home Reviews

- Update coverage after marriages, home purchases, new businesses, or significant asset changes.

Your assets are too valuable for “standard” protection. With umbrella liability insurance from Concierge Insurance Group, you gain a private client experience—white-glove service, tailored coverage, and local expertise—so you can live boldly, knowing every corner of your life is safeguarded.