In August 2023, Chicken Creek overflowed after 7 inches of rain, flooding a Milton barn and basement to three feet.

The homeowners discovered their private-client policy excluded surface-water damage; the NFIP policy they skipped would have paid $250 000.

Below you’ll find exact maps, cost tables, and three smart ways to slash flood premiums while keeping luxury coverage.

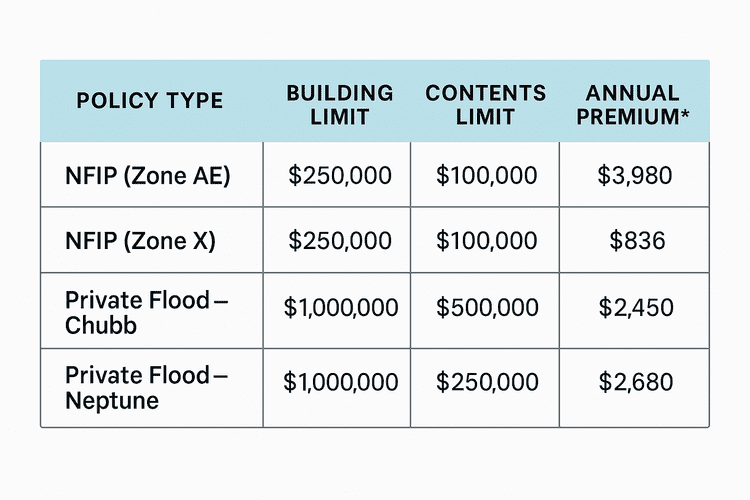

1 · NFIP vs Private Flood — $1 M Home, No Prior Claims

*Quotes pulled May 2025; includes basement coverage and $10 000 loss-of-use.

2 · Elevation-Certificate ROI in Milton

*Quotes pulled May 2025; includes basement coverage and $10 000 loss-of-use.

- Avg elevation certificate cost: $650.

- Premium drop after EC: –$1 200/yr (Zone AE ➜ X after LOMA).

- Payback: ~7 months.

3 · Hidden Gaps in Luxury Policies

- Basement valuables (wine cellars, gyms) exceed NFIP $100 k contents cap.

- Detached barns need their own schedule; NFIP covers main dwelling only.

- Loss-of-Use not included in NFIP; private flood offers $50 k–$100 k.

Frequently Asked Questions

Is creek overflow considered “surface water”?

Yes—homeowners and water-backup endorsements exclude it; only flood insurance pays. Can I get flood in excess of NFIP limits?

Yes, private flood carriers offer up to $5 M building limits for Milton ZIP 30004. Will a retention pond lower my rate?

Protect Your Property — Get Expert Flood Coverage Help Today