Deductibles: $1,000 vs. 2% — Which Saves You More in the Long Run?

A $40,000 Pipe Burst Proved It: A $1,000 Deductible Was Cheaper Than a 2% Policy.

Imagine you just saved $400 a year by switching your home policy to a 2% deductible. Sounds smart, right? That is, until a pipe bursts upstairs and your out-of-pocket cost hits $8,000. Meanwhile, your neighbor—still carrying a $1,000 flat deductible—paid far less for the same repair. Here's how to avoid that surprise.

1. Flat vs. Percentage-Based Deductibles: What You Need to Know

Every homeowner insurance policy includes a deductible, but not all deductibles are created equal.

- Flat Deductible: This is a fixed amount—say, $1,000—that you pay out-of-pocket before your insurance steps in. It's predictable and easy to budget for.

- Percentage Deductible: This is based on a percentage of your home's insured value. A 2% deductible on a $1 million home means you'd pay $20,000 before insurance contributes a dime.

The key difference? Flat deductibles stay the same no matter what. Percentage deductibles scale with your home's value. As your property appreciates, so does the deductible—and not always in ways that make sense for your financial comfort.

2. The Real-World Math: $1,000 vs. 2%

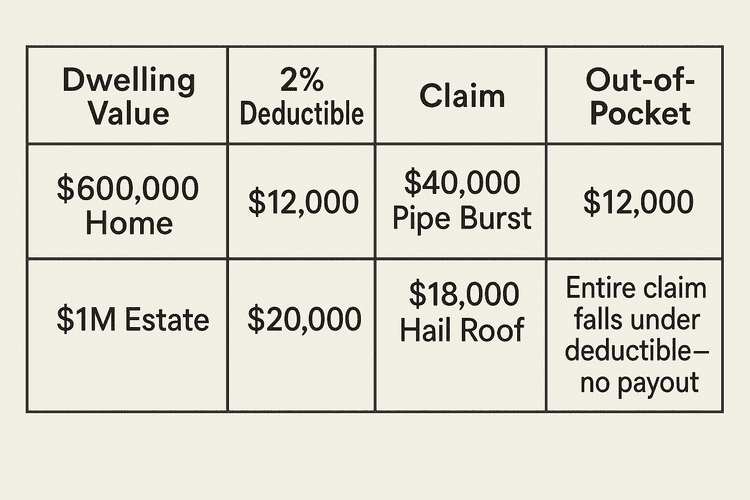

Let's break it down with real-life scenarios:

If your deductible exceeds your claim amount, your insurer doesn’t pay anything. That means a hail-damaged roof worth $18,000 on a million-dollar estate could result in zero reimbursement—simply because the deductible is too high.

Even when claims are approved, a large deductible can eat up a substantial chunk of the repair cost. It’s not just about premium savings—it’s about cash flow when the unexpected happens.

3. When a 2% Deductible Might Make Sense for You

There are situations where a higher deductible might be the right call—but only if:

- Your home is newer or recently updated, especially the roof and plumbing.

- You have strong liquid reserves, typically $25,000 or more, earmarked for emergencies.

- You rarely file claims and are willing to self-insure for moderate losses.

This approach can lower your annual premium slightly, but it increases your financial exposure. It works best for those who treat insurance as protection against catastrophic loss only—not for more routine damage.

Still unsure? We'll help you compare options using your actual home value and risk profile—so you're not left guessing.

Your Next Step: Aligning Deductibles With Your Lifestyle

Your home deserves more than a one-size-fits-all policy. Choosing the right deductible is about balancing peace of mind with smart financial planning. Let’s review your current setup and make sure it reflects the life you’ve built.

Explore More:

- What Drives the Cost of Home Insurance?

- Why High Net-Worth Households Need Umbrella Coverage

Protect What You’ve Built. Schedule a private consultation with a Concierge advisor to fine-tune your deductible strategy.