How Much Umbrella Insurance Do You Need in Milton, GA?

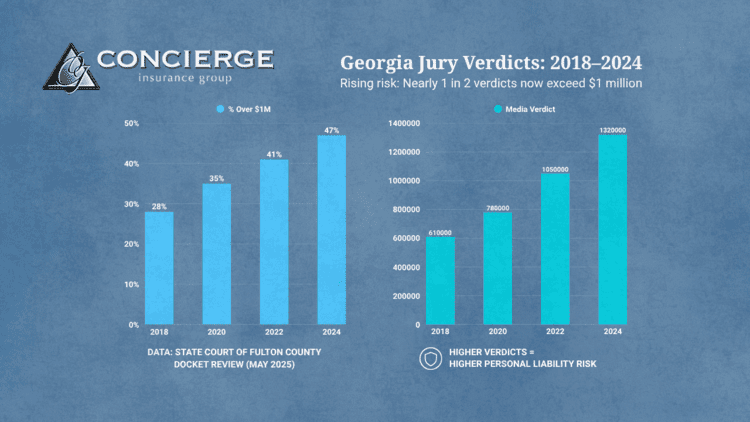

If you own property, host guests, or have teenage drivers in Milton, Georgia, you may be far more financially exposed than you realize. Over the past few years, personal-injury verdicts in Georgia have increased sharply—nearly half now exceed $1 million. Many homeowners still carry base liability policies that max out at $300,000 to $500,000, which can leave them dangerously underinsured if a serious accident occurs.

This article will walk you through why Georgia’s legal landscape is making high-limit umbrella coverage essential, how much a $5–10 million umbrella policy really costs, how to compare major insurers like PURE, Chubb, and Cincinnati Executive, and how to ensure your coverage actually works when trusts, LLCs, or complex assets are involved.

Georgia Lawsuit Trends Are Driving Higher Risk for Homeowners

In Georgia, median jury verdicts for personal-injury cases have risen consistently over the last six years. Here’s how the numbers have changed:

*Source: State Court of Fulton County docket review, May 2025

For families who host social events, employ domestic staff, or have newly licensed drivers, the risk of a high-dollar lawsuit is no longer hypothetical. Even a relatively modest claim can turn catastrophic, quickly exhausting base policy limits and leaving personal assets exposed.

What Umbrella Coverage Costs in Milton, GA

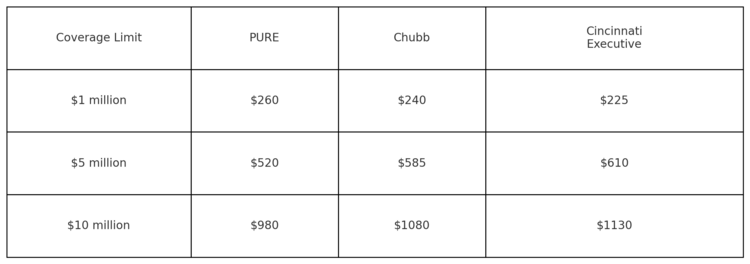

Despite the risks, the cost to significantly raise liability protection remains surprisingly low. Below are current annual premium estimates from three major carriers based on ZIP code 30004, with two vehicles and a clean driving record:

A $5 million umbrella can often be added for under $600 per year, providing meaningful protection without dramatically impacting your overall premium structure. It's one of the most cost-effective ways to safeguard wealth, income, and reputation.

If you’d like to see what your exact premium would be, request a personalized quote for ZIP 30004.

Properly Layering Umbrella Coverage Over Trusts and LLCs

It’s common for high-net-worth families to title homes, vehicles, or other assets in trusts or LLCs for estate planning or asset protection. However, doing so incorrectly—or without updating insurance documents—can create gaps that make umbrella coverage ineffective.

To ensure proper layering:

Add an “additional insured – trust” endorsement. PURE uses form PL-TRU, but the name may vary by carrier.

If a home is titled in an LLC, list the LLC as a named insured on both your home and umbrella policies.

Review how vehicles are titled. If a vehicle is titled to a child or business entity, umbrella coverage must extend to that titleholder.

Most umbrella claims that are denied or delayed stem from these exact technical oversights. Reviewing title and ownership alignment is essential to avoid exposure.

Common Gaps in International, Equestrian, and Marine Liability

Many umbrella policies advertise broad coverage territory, often using the term “worldwide.” But exclusions still exist, especially when specific high-risk activities or property types are involved.

Here are three scenarios that typically fall outside standard umbrella protection:

Long-term vacation rentals (over 30 days) are usually excluded unless the carrier approves and underwrites the exposure.

Horse owners who board or train horses may require a separate Care, Custody & Control (CC&C) liability policy underneath the umbrella.

Boats over 26 feet often require a standalone Protection & Indemnity (P&I) policy in order for the umbrella to attach.

These gaps can be especially problematic for families who own rural properties, horse farms, or international real estate. Without the right underlying coverage, an umbrella policy will not respond when needed.

Frequently Asked Questions About Umbrella Coverage

Will an umbrella policy cover my college-age driver?

Yes, provided the child is listed as a driver on your auto policy and the vehicle is also scheduled. PURE may charge a surcharge, but coverage is generally not excluded.

Should my umbrella limit match my net worth?

That’s a good baseline. However, due to rising verdicts and legal fees, many advisors now recommend limits equal to 1.5 times your net worth to ensure sufficient defense and judgment protection.

Do defense costs count against the umbrella limit?

No. Carriers such as PURE and Chubb pay legal-defense costs outside the policy limit, preserving the full amount of coverage for any settlement or award.

What to Do Next

Georgia’s legal climate has changed dramatically, and umbrella limits that once seemed generous are no longer sufficient in many real-world situations. If your liability coverage hasn’t been reviewed recently, especially in light of rising verdicts and asset ownership structures, now is the time.

Make sure your umbrella policy is properly layered over any trusts or LLCs. Confirm that all vehicles and properties are correctly titled and scheduled. And if you’re unsure what limits are appropriate for your situation, reach out for a second opinion or personalized quote.

The peace of mind that comes with knowing your liability structure is sound is well worth the effort.

Start your umbrella quote today and take the first step in securing the coverage your assets deserve.